Preparation

Our latest adventure is the Panamericana route from north to south; that is from Alaska to Tierra del Fuego with our expedition vehicle. The planning effort for a long-term trip with your own vehicle should not be underestimated. Especially in the case of a deregistration in Switzerland. Here is a summary of why (status 2020).

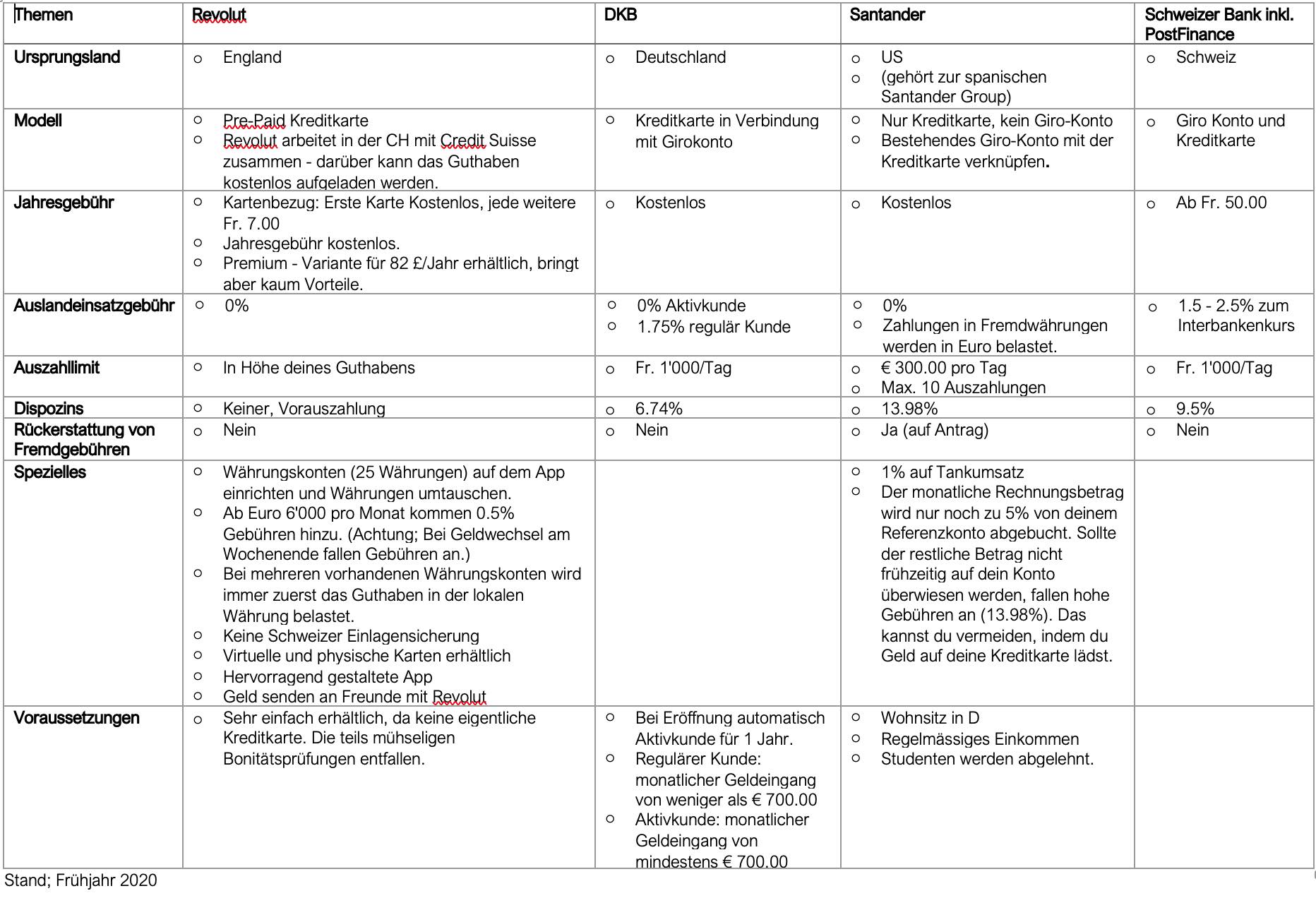

Finances/ Credit cards

Don’t we all know it? With the classic credit cards abroad, it can quickly become expensive. Fixed annual fees, costs for cash withdrawals and horrendous surcharges for payments in foreign currencies? For travelers, Swiss credit cards are an expensive solution. Especially in countries where only small amounts of cash can be withdrawn, it can be painful. However, there are options, which are excellent. To do this, however, you first need to think about your own cash supply needs. The important points for us are:

- No annual fee

- Free cash withdrawal

- No foreign transaction fee (payment at the interbank rate without surcharge)

- Various currency accounts and easy exchange

We have summarized the different versions for you.

Our conclusion: After thoroughly looking into it, we decided to go with the combination

DKB and Revolut.

- With Revolut, we pay directly abroad, due to 0% foreign transaction fee, this is very interesting, analogous to the DKB.

- With Revolut we have different currency accounts. In interesting exchange rate constellations, we exchanged money within seconds, which can be enormously rewarding.

- With DKB, we can withdraw cash worldwide free of charge.

- Our bank accounts are with a Swiss bank and PostFinance respectively. From there, we load 700€ monthly to our travel account at DKB to keep the status of active customer.

- Santander was unfortunately not possible for us as Swiss citizens.

- Open an account directly with DKB

Visa

USA

In order to obtain a visa for 6 months, we need to fill out the application for B1/B2 visa. The US Visa on Arrival is 90 days, which is too short for us. While browsing the internet we almost get scared; do the officials at the US Embassy really want to know so much about our lives and make sure that we will leave the US at some point? Well; we prepare ourselves accordingly and try as far as possible to put arguments together to present our Swiss roots. So-called “Binding Ties” the Embassy wants to see from us. Among others: fixed employer, fixed income, property ownership, etc.

Step one is to fill out the US visa application (B1/B2) online. About two hours should be reserved for this, the questionnaire is quite extensive. In the second step the visa fees of US 160.00 each have to be paid. After that, a date must be chosen for the personal interview.

After investing some time, we had our appointment; and on very short notice, despite announcements of backlogs due to Corona. So we prepare ourselves with all kinds of documents, extracts and summaries about our income. Excited, we make our way to the US Embassy in Bern.

After extensive security checks, the interview is kept very short. None of the questions about our “Binding Ties” in Switzerland. Even if we had been prepared for it, we are glad. The visa is approved. The only big downer; Since entry into the USA is still prohibited due to the Corona virus, the visa is not yet issued, we take our passports back home. As soon as the border is open, we can send them in and get our visa registered.

Health

Health is an important topic. This also includes vaccinations. Which vaccine is recommended for each destination can basically be gathered by doing your own research on the Internet. This is exactly what we did and subsequently compared our vaccination record with the knowledge we gained, after we had a look at the following page.

In the end, it is still worthwhile to check the results with a specialist as part of a travel medicine consultation. We have already had two very good experiences with the vaccination and travel medicine of the Inselspital Bern. Chargeable hotlines also offer travel medical advice. We made a conscious decision to go to Inselspital because we wanted to do the necessary vaccinations right after the interview. After about two hours, everything was done and another chapter on the subject of preparation was ticked off. The following topics were relevant for our Panamericana adventure:

Diarrheal disease

Diarrhea is one of the most common illnesses that travelers can experience. Prevention is the best measure to avoid them. Therefore: Cook it, boil it, peel it or leave it. However, if diarrhea should occur, it is recommended to drink enough, eat salty food or a bouillon.

Rabies

Bite wounds from dogs, cats and rodents can unfortunately not be excluded. Vaccination is therefore recommended for Central and South America, which is considered a medium risk area.

Dengue

Dengue fever is the most common insect-borne infectious disease worldwide. Unfortunately, there is no specific therapy. Besides dengue, there are other diseases caused by insect bites – for example, chikungunya fever and ZIKA – for which there is also no treatment. Preventive protection against mosquito bites is therefore all the more important: long clothing, highly effective mosquito repellent (DEET content between 30-35%) and avoid standing water, respectively. replace it regularly with fresh.

Typhus

A serious bacterial infection transmitted through contaminated drinking water and food. As a therapy there is an oral vaccination. However, since this is only effective for about 1.5years, we will only take it when we enter the risk area of South America.

Yellow fever

A severe viral infection transmitted by a species of mosquito. Yellow fever is one of the diseases caused by mosquito bites, which can be vaccinated. Vaccination is strongly recommended; in addition, most high-risk countries require proof upon entry. Accordingly, we underwent the yellow fever vaccination.

Malaria

Malaria prophylaxis should be taken in South and Central America. Two drugs are available on the market; Malarone or Mephaquin. These differ in terms of side effects, frequency of use and also prices. Malarone can also be used as emergency therapy.

Tetanus / Diphtherie / Pertussis

The bacterial infections, which enter the body via pathogens through wounds, can have very serious consequences. Since this vaccination has to be refreshed every 10 years, we had ourselves revaccinated for our trip.

Other important health issues include: Be careful when swimming in stagnant or slow-moving freshwater, which can lead to worm disease in certain areas (schistosomiasis). One challenge in South America is altitude sickness – good preparation and acclimatization is essential to avoid this. Last but not least, you should be aware of the risk of traffic accidents, especially in Asia, South America and Africa where the accident rate is extremely high. Caution should be exercised especially when using public transportation with overtired chauffeurs.

Deregister

Deregister from Switzerland or not? This question arises with every long-term trip and has corresponding advantages and disadvantages. There are a few things to keep in mind.

Trip duration

In principle, deregistration is mandatory if the stay abroad lasts longer than one year. This may also vary from residential community to residential community. It is best to contact them early so they can inform you of the regulations that apply. A deregistration entails many things, the administrative effort is not to be underestimated. Therefore, weigh the advantages and disadvantages well and then decide for a deregistration or registration, unless it is generally mandatory for your trip.

Deregistration process

Once you have all the information, deregistration is a short affair. Go in person to your community of residence. There you must submit the appropriate form “Departure abroad”.There are representative address and authorized persons during the absence are specified. Based on this form, the municipality informs the tax authority, which then triggers the tax return. You will receive a deregistration certificate with which insurance policies can be terminated without notice. In addition, you will get back the certificate of residence, so that it can be handed in again when you register again later.

Impact

There are a few of these. The most important ones are summarized here:

Health insurance

If you are registered, you remain covered by compulsory health insurance. Swiss health insurances are much more expensive compared to international offers. In addition, the coverage for your destination country will most likely not be sufficient. Therefore, you need to take out additional insurance. International insurance companies have much better offers for long-term travelers. You can find the details in the section Preparations – Insurances.

Military

The Compulsory military service is suspended for the time spent abroad. Accordingly, during this period, no summons to military/civilian service or civil defense will be issued.

Pension fund

If you are not employed, there is automatically a gap in contributions. Upon resumption of employment, the pension fund will be continued again. If you quit your job, you will be sent a form to transfer the pension fund funds. Since this cannot be transferred to a new employer, it must be parked in a vested benefits account. This can be set up with insurance companies and banks. There are not too many differences in fees and services. If you do not report a vested benefits account, the money either remains with the previous employer or goes to the BVG supplementary institution.

Retirement and survivors' benefits (AHV)

If you deregister, you are no longer obliged to pay AHV contributions. Accordingly, gaps in contributions occur if no contributions are made for an entire year. However, these gaps can be closed by paying in the minimum contribution per year. This can also be done after the stay abroad, subject to a period of 5 years. So register with the AHV branch office in your canton of residence and register as “not gainfully employed”. The amount of the contribution is calculated according to assets and income, but the minimum contribution is currently Fr. 496.00 per year. The retirement and survivors’ benefits branch usually asks for proof of your trip around the world to make sure that you really will not be gainfully employed.

Contracts

With the deregistration certificate from the municipality, all existing contracts can be terminated without notice. So remember to cancel the following contracts: Compulsory health insurance and supplementary insurance, vehicle insurance, household insurance, legal protection, mobile subscription, credit card, BILAG/TV/Internet, etc. Also, do not forget to leave a power of attorney with banks.

Taxes

By deregistering, you are exempt from tax liability. This means cost savings. However, this also means that no tax declaration has to be filled out during the stay abroad. Two advantages which in our case clearly spoke for the deregistration. In order for the municipality to issue the deregistration certificate, the outstanding debts must be settled. The tax declaration for the current year is initiated after the official deregistration. Financially, it is very important on what date you sign off. The best moment is as of the end of December. If you opt out during the year, a rate-determined income is calculated by extrapolating your income over twelve months. Your final tax bill will be much higher as a result. If you still want to leave in the middle of the year, you should calculate the total costs. It may make sense to deregister by the end of the year anyway. Here you accept that the health insurance premiums will still accrue, but this may still be cheaper than the higher tax liability if you deregister during the year. In order to get the most out of it, we decided to deregister at the end of the year.

Conclusion

For us, the decision was clear; we are signing off. First, we plan to be on the road for significantly longer than a year, which will require us to sign off either way. Anyway, the advantages clearly outweigh the disadvantages. The main disadvantage is certainly the great administrative effort. In return, there are significantly lower costs and fewer obligations. It is important to start preparations early to avoid any surprises.

health insurance

A very important topic is the foreign health insurance. It’s only limited fun, because it means spending hours reading through insurance terms and conditions. But that’s where the small print can get in the way – so it’s better to take the time to compare the different offers.

The basic question is: Deregister from Switzerland or not? Once this decision has been made, only then does it make sense to look for the appropriate insurance.

Variant 1: Stay registered

With a fixed residence in Switzerland, every citizen is obliged to pay the compulsory health insurance. In principle, this covers “emergencies” abroad. What the insurance then considers to be an emergency will probably only become clear at this point. In each case, a maximum of twice the costs that would be incurred for treatment in Switzerland is paid. A detailed clarification and the conclusion of a supplementary insurance can therefore be quite sensible. Especially if the trip is planned to more expensive countries like the USA, Canada, Japan or Australia. In addition, repatriation to Switzerland is covered by basic insurance only in very rare cases. Due to the permanent residence in Switzerland there are some options. For example, STA Travel Insurance (up to 4 months), Hanse Merkur Switzerland, Global Alliance Assistance or an additional insurance through the mandatory health insurance.

Variant 2: Deregister

Since we have deregistered from Switzerland, our options are severely limited. As a Swiss citizen without a permanent residence, it is very difficult to find a suitable insurance. Finally, we were able to distinguish between two valable offers, all other requests were unsuccessful. To give you an overview, here is a summary of the options we evaluated.

Hanse Merkur Switzerland

- No insurance without permanent residence in Switzerland

STA Travel

- No insurance without permanent residence in Switzerland

- Maximum travel time 4 months

Pro Trip

- No insurance for Swiss citizens

- Only German and Austrian citizens

- Maximum travel time 5 years

ADAC

- No insurance for Swiss citizens

- German citizens only

- Maximum travel time 2 years

Travel Secure

- No insurance for Swiss citizens

- Only for German citizens

- Maximum travel time 1 year

World Nomads

- Available for Swiss

- Maximum travel duration: 1 year (can be extended continuously)

- Contract with USA/Canada: Cost per month from (Basic; $ 124, Explorer; $ 130)

- Contract without USA/Canada: Cost per month from (Basic; $ 97, Premium; $ 103)

- Deductible $ 100.00

- Language: English

- Explorer-Tarif; Incl. Extreme sports

- Insurance coverage Switzerland: Only without USA/CAN tariff

- Very common among long-term travelers

- Rates incl. Luggage and travel cancellation insurance

Young Travellers:

Rates Young Travellers

- Available for Swiss

- Maximum travel time: 2 years (can be extended in case of short home stay)

- Completion with less than 50% USA/Canada, travel time 2 years: cost per month between € 42 to € 62 (depending on age)

- Completion with more than 50% USA/Canada, travel time 2 years: Cost per month between € 50 to € 105 (depending on age)

- Deductible: € 0

- Unlimited insured sum

- Language: German

- Agent: Uwe Dittner

- Pregnancy, work and all sports insured

- Insurance coverage Switzerland: 8 weeks

- Additional modules such as luggage, accident and liability insurance can be selected

Young Travellers:

Tarif STAY Travel

- Available for Swiss

- Maximum age: 39 years

- Maximum travel time: 5 years

- Completion without USA/Canada: Costs per month from (Basic; 49€, Premium; 71€)

- Completion with USA/Canada: Cost per month from (Basic; 64€, Premium; 83€)

- Deductible € 100.00 (Basic) or € 0.00 (Premium)

- Rates are lower under 22 years of age.

- Insurance coverage in home country: 6 weeks

- The insurer is the Hanse-Merkur Group

- Agent: Uwe Dittner

Our decision:

We considered the offer of World Nomads as well as the insurance solutions of Young Travellers. Due to the competent and quick advice by Uwe Dittner we decided for Young Travellers. This is based on the insurance solution of the Hanse Merkur Group. We were also impressed by the very good price/performance ratio and the high and comprehensive coverage in the event of a claim. We have combined this with the “STAY Travel comfort protection package”. This includes travel accident, travel liability and luggage insurance in the amount of € 2’000.00 luggage value. As Swiss, the insurance can be concluded viareiseversicherungbuchen.de. For German citizens also directly via the Hanse-Merkur Group

As passionate mountain bikers and also otherwise always ready for an adventure, it is important for us to have insurance against disability. That is why we decided to become a member of the Swiss Paraplegic Foundation. Regardless of other insurance benefits, place of treatment or place of residence, in the event of an emergency the Foundation will pay Fr. 250’000.

With Rega membership, we also receive support in medical emergencies – right up to transport back to Switzerland.

vehicle insurance

With the Swiss motorhome on a trip around the world; the planning has it in itself. There are several variants, each with its advantages and disadvantages. Unfortunately, there is no 100% satisfactory solution. This is despite the fact that the road traffic authorities are well aware of the problem.

Travel with the original plate

For this purpose, the vehicle must remain registered with the relevant road traffic office. This has the following consequences:

- Road tax is to be paid

- Liability insurance remains due

- Vehicle inspections are to be carried out according to the specifications of the road traffic office

- If necessary, a suspension of the premium can be discussed with the insurance company for trips outside Europe against presentation of the shipping documents. In return, international liability insurance must be taken out.

Deregister vehicle

This variant means that the license plate and vehicle registration document must be handed in at the responsible road traffic office. There are travelers who have copies made of a license plate (for example, at Turi Funk). Whether international vehicle insurance will provide coverage in the event of an incident is questionable, since legally a vehicle must be registered somewhere.

Deposit license plate

By depositing the plates, the vehicle remains registered, i.e. you remain in possession of the vehicle registration papers. For example, the license plate can be deposited in the canton of Bern for one year and renewed for another 12 months. At this time, the license plate expires, is it not redeemed. During the “suspended” period, the technical inspection is also not due. In addition, the road traffic tax as well as the compulsory liability insurance is void from the moment of suspension. This variant also involves traveling with a copy of the license plate (Turi Funk). It is mandatory that the original plate is still attached when leaving the port in Europe.

Return to Switzerland

- Regardless of whether entry is by land or sea: From the moment European soil is entered (in the area of validity of the green insurance card), the original plate must be attached.

- This means that the vehicle must first be officially redeemed at the Road Traffic Office. Only with the original plate it is allowed to cross Europe.

- A pickup of the plates at the responsible road traffic office resp. having it sent to an address near the port is inevitable.

- In addition, in this case, the next technical examination is scheduled in the relatively short term.

Our camper, which is considered a heavy camper, has to be presented every 2 years. Ignoring the request will have unpleasant consequences. Unfortunately, long-term travelers are limited in time, as long as they travel with the original license plates, which is basically the safest option, even if it is a bit more expensive. In any case, it is recommended to voluntarily present the vehicle again before departure.

Once you have decided which option you want to start your road trip with, the question of insurance arises. A liability insurance for the respective country is obligatory. For the route of the Panamericana a challenging task. Nice to have is a comprehensive insurance. We’ll explain why below.

Comprehensive insurance

With deregistration in Switzerland and shipping to another continent, most Swiss insurances refuse to cover the comprehension. However, since our vehicle has a high emotional value for us, we would like to insure it. Also knowing that in South America, for example, many locals have no liability insurance. So even through no fault of your own – the bill can be expensive. As a foreigner, you often have the short end of the stick. In addition, something can happen quickly with so many kilometers, which is why we wanted to cover this risk. Through testimonials from other Swiss travelers we found what we were looking for. We opted for fully comprehensive insurance.

Liability insurance

Insurers for vehicles are countless and yet none. Definitely one of the more challenging topics of preparing a Panamericana adventure. Basically, liability insurance is mandatory. Customs officials would have to check this when crossing the border resp. check when importing the vehicle via sea route. However, travelers report that insurance is rarely if ever asked for. The cargo company “Seabridge” also states that to date the papers are not checked when leaving the port. Nevertheless; vehicle liability insurance should be in the interest of every traveler. In the event of an accident, this can otherwise have unpleasant consequences.

For the comprehensive insurance we came across a Swiss insurance solution that has an offer for the USA & Canada: Mobiliar Insurance. Patrik Betschart from the Lucerne branch advised us competently and made us an offer for fully comprehensive insurance.

Liability insurance Panamericana

Mandatory before entry

- Canada/USA

- Mexico

- Colombia

- Peru

- MercoSur (Bolivia, Chile, Argentina, Paraguay, Brazil and Uruguay (can be contracted online)).

At the border

- Central America

- Ecuador (taken over by the state)

In Central America – and partly South America – insurance policies can often be taken out at the border or near the border at various insurance offices for the respective country. In South America, there are offers that cover several countries, usually the conclusion is possible online. On the website of Panamericana Infoyou find a lot of useful information about vehicle insurance and links to the various brokers in Central and South America.

With early information before each border crossing, South and Central America should not face any major challenges. Under our section “On the road” we will keep you up to date with experiences on the ground.

The issue is more complicated in the USA/Canada. After inquiries with countless providers, we received negative or no feedback from most of them. These four providers were able to make us an offer, on very different terms and conditions.

Seabridge

Contact: www.seabridge-tours.de, seabridge@t-online.de

Offer:

- Unfortunately, as of 2018, Seabridge is no longer able to broker insurance due to new privacy regulations.

- Seabridge therefore refers to the following providers, which can be requested for USA/Canada

1. Thum Insurance

2. MCTI: Macdonald Chisholm Trask Insurance

3. Segurogringo

MCTI

Contact: laura.fitzgerald@mcti.ca

Offer:

- Liability insurance for90 days. No comprehensive insurance

- Coverage amount high with $2 million, but premium for 90 days very high.

Thum Insurance

Contact: sue@thuminsurance.com

Offer:

- Option for liability and comprehensive insurance for USA (without Canada).

6 or 12 months term - The coverage amounts are okay at $500,000. The insurance premiums, however, very high. Sue is very quick to give answers and provide you with a quote.

- Besides the high cost, another disadvantage is that the insurance cannot be interrupted. The route Alaska – Canada – USA is therefore not feasible at all, which is very unfortunate.

- Reason for rejection Canada: Since 01.07.2019 no insurance for 4×4 vehicles is offered for Canada. A standard motorhome equipped with bathroom, kitchen and bed may receive an offer for USA & Canada.

Segurogringo

Contact: fernando@segurogringo.com, www.segurogringo.com

Offer:

- Liability insurance for 30, 90 or 180 days (with renewal possible).

- Low coverage amounts ($60,000).

In return, reasonable premiums and uncomplicated online conclusion

We received feedback from TourInsure, Fernet Insurance, Blue Sky Insurance, RV America & Assurantiekantor that they cannot offer insurance in the USA. We received no response at all from Lions Group & WinstonInsurance to our inquiries.

Conclusion: The choice is between very high premiums and adequate coverage, or low coverage with affordable premiums.

© Howis-web